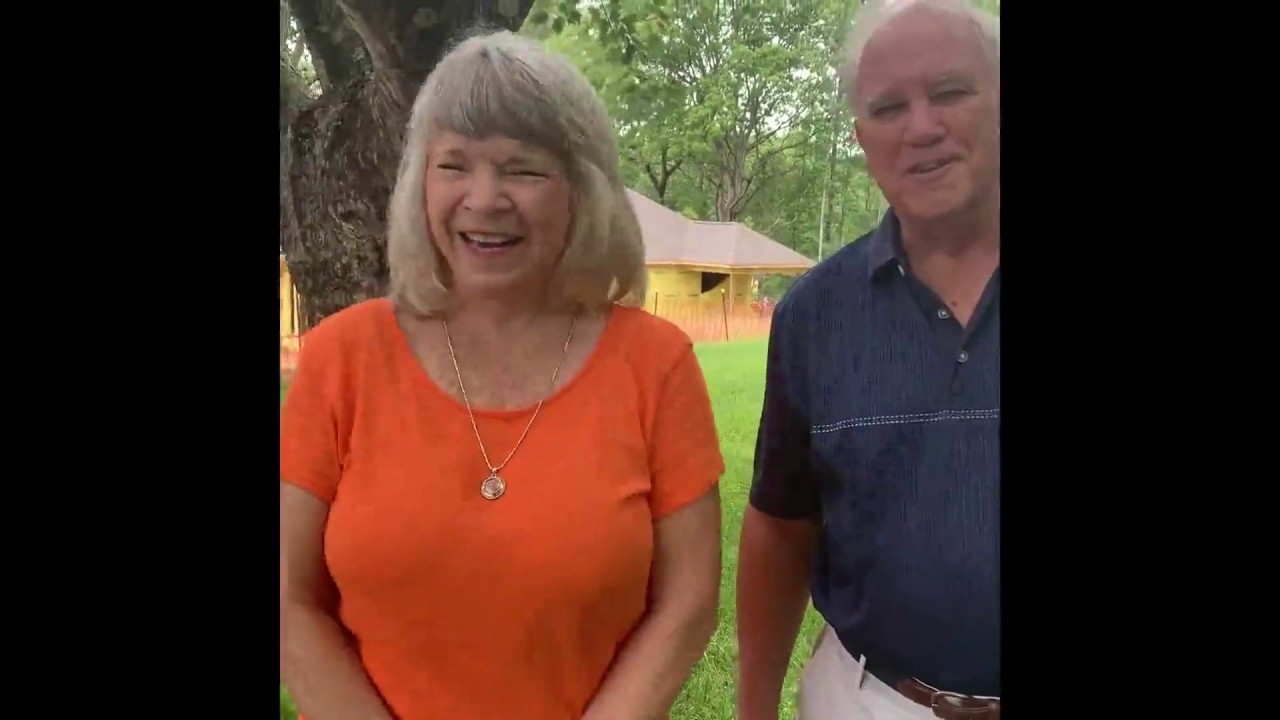

In the videos below, you’ll meet two past homeowners who purchased a $500,000 home with a one-time payment (at closing) of $330,000 and will never make a monthly mortgage payment. You read that right – and nearly 25% of our homeowners have used the Home Equity Conversion Mortgage to purchase – and own – one of our maintenance-free homes.

Those who have served America in the Armed Forces deserve special benefits when it comes to achieving the American Dream. VA loans, with a $0 down payment and other lifetime benefits, are an option for many of our buyers.